Our website uses cookies, which helps us to provide services that are right for you. By continuing to use our website, you agree to our Cookie Policy.

Margin and leverage

Margin requirements

Before you start trading, it is important to familiarize yourself with the margin requirements. Margin is the total value of funds in a client’s account that are reserved to support the client’s open positions.

Based on the margin requirements, you can calculate the maximum leverage that is applied depending on the selected instrument for trading.

Specific leverage values for certain groups of instruments depend on the financial instrument itself, and not on the overall leverage of the trading account. This is described in more detail in the following table:

| Margin group | Leverage | Position size, $ | Margin, % |

|---|---|---|---|

| Currencies | 1:500 | 0 - 1 000 000 | 0,2 |

| 1:200 | 1 000 001 - 1 500 000 | 0,5 | |

| 1:100 | 1 500 001 - 2 000 000 | 1 | |

| 1:50 | 2 000 001 - 3 000 000 | 2 | |

| 1:25 | 3 000 001 - 4 000 000 | 4 | |

| 1:10 | 4 000 001 - 5 000 000 | 10 | |

| 1:1 | over 5 000 000 | 100 | |

| Metals | 1:100 | 0 - 100 000 | 1 |

| 1:50 | 100 001 - 200 000 | 2 | |

| 1:25 | 200 001 - 500 000 | 4 | |

| 1:10 | 500 001 - 1 000 000 | 10 | |

| 1:1 | over 1 000 000 | 100 | |

| Commodities | 1:100 | 0 - 50 000 | 1 |

| 1:50 | 50 001 - 100 000 | 2 | |

| 1:25 | 100 001 - 200 000 | 4 | |

| 1:10 | 200 001 - 500 000 | 10 | |

| 1:1 | over 500 000 | 100 | |

| Indices | 1:100 | 0 - 50 000 | 1 |

| 1:50 | 50 001 - 100 000 | 2 | |

| 1:25 | 100 001 - 200 000 | 4 | |

| 1:10 | 200 001 - 500 000 | 10 | |

| 1:1 | over 500 000 | 100 | |

| Shares | 1:5 | Any position volume | 20 |

| Cryptocurrencies | 1:5 | Any position volume | 20 |

Examples of margin calculation based on the margin requirements:

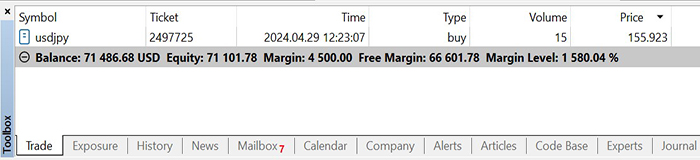

Order with the instrument USDJPY at a price of 155.923

- Contract size: 15 lots

- Margin = Volume (amount of lots) * Contract size / Leverage

- Margin = 15 * 100 000 = 1,500,000 USD nominal volume

First level 1,000,000 / 500 = 2,000

Second level 500,000 / 200 = 2,500

= 4500 USD

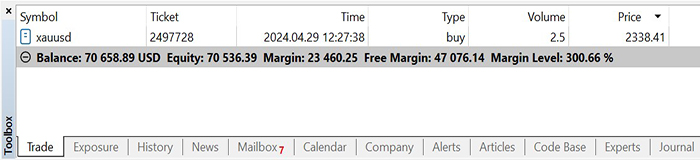

Order with the instrument XAUUSD at a price of 2,338.41

- Contract size: 2.5 lots

- Margin = Volume (amount of lots) * Contract size * price / Leverage

- Margin = 2.5 * 100 * 2,338.41 = 584,602.5 USD nominal volume

First level 100,000 / 100 = 1,000

Second level 100,000 / 50 = 2,000

Third level 300,000 / 25 = 12,000

Fourth level 84,602.5 / 10 = 8,460.25

= 23,460.25 USD

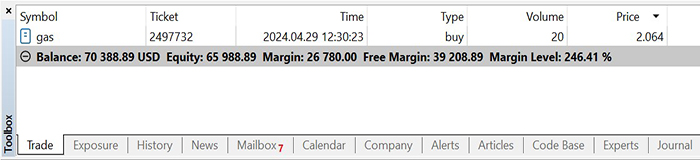

Order with the instrument GAS at a price of 2.064

- Contract size: 20 lots

- Margin = Volume (amount of lots) * Contract size * price / Leverage

- Margin = 20 * 10 000 * 2.064 = 412,800 USD nominal volume

First level 50,000 / 100 = 500

Second level 50,000 / 50 = 1,000

Third level 100,000 / 25 = 4,000

Fourth level 212,800 / 10 = 21,280

= 26,780 USD

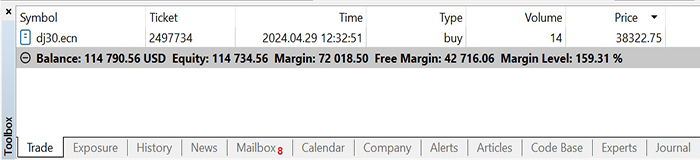

Order with the instrument DJ30 at a price of 38,322.75

- Contract size: 14 lots

- Margin = Volume (amount of lots) * Contract size * price / Leverage

- Margin = 14 * 1 * 38,322.75 = 536,518.5 USD nominal volume

First level 50,000 / 100 = 500

Second level 50,000 / 50 = 1,000

Third level 100,000 / 25 = 4,000

Fourth level 300,000 / 10 = 30,000

Fifth level 36,518.5 / 1 = 36,518.5

= 72,018.5 USD

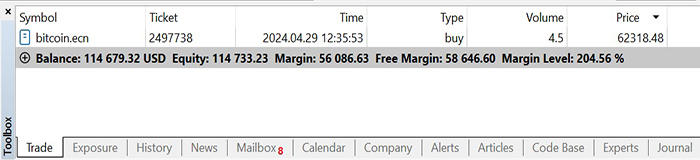

Order with the instrument Bitcoin at a price of 62,318.48

- Contract size: 4.5 lots

- Margin = Volume (amount of lots) * Contract size * price / Leverage

- Margin = 4.5* 1 * 62,318.48 = 280,433.16 USD nominal volume / 5 = 56,086.63 USD